Cryptocurrency has become a major force in the financial world, and with that comes the need for secure storage. Crypto wallets offer users the ability to store and manage their digital assets securely, making them an integral part of any cryptocurrency investor’s toolkit. But what are the benefits of having a crypto wallet? Read on to find out! We’ll discuss what a crypto wallet is, the different types of wallets available, how to manage digital assets within a wallet, and additional considerations before signing up for one. So strap on your seatbelt — we’re about to explore the exciting world of crypto wallets!

What is a Crypto Wallet?

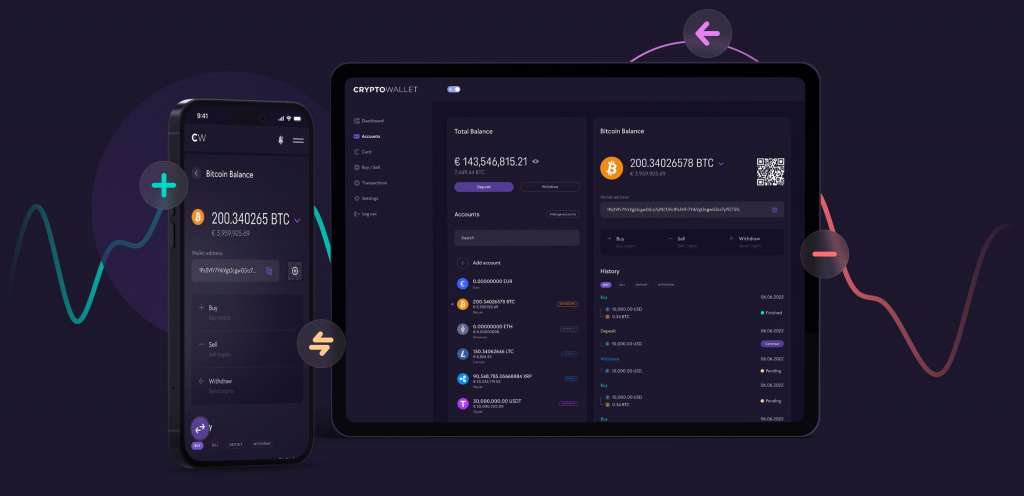

A crypto wallet is a digital storage device that enables users to store and manage their cryptocurrency assets. It provides an easy-to-use interface for users to send and receive cryptocurrencies, monitor transactions, and view their balance. Crypto wallets come in various forms including hot wallets (available on mobile devices or web-based), cold storage (hardware wallets or paper wallets stored offline), and non-custodial wallets which do not hold the user’s private keys. Crypto users should consider factors such as security features, ease of use, transaction fees, two-factor authentication, and compatibility with different cryptocurrency exchanges before selecting a wallet that best suits their needs. Ultimately it is important to remember that financial decisions should be made with the help of qualified professionals.

Having a crypto wallet is an essential part of managing your cryptocurrency assets, and it pays to do your research before selecting a wallet that fits your needs. Next time, we’ll explore the benefits of using a crypto wallet and discuss how they can help you capitalize on the advantages of digital currencies.

Using a crypto wallet has its advantages.

The use of crypto wallets is becoming increasingly popular, as they provide significant benefits for users. Crypto wallets allow for the secure storage of digital assets and safe and secure currency transactions safely and securely. Crypto wallets also enable users to store their private keys offline and securely, providing an extra layer of security that is not available when using other types of wallets. Additionally, crypto wallets are generally user-friendly and easy to set up, allowing users to quickly get started with managing their cryptocurrency investments. Furthermore, most crypto wallets offer seed phrases that can be used to restore access in case a user’s device fails or is lost. Finally, many crypto wallet providers offer two-factor authentication measures which further enhance the security of the wallet. All these features make crypto wallets an attractive option for investors looking for a convenient way to manage their digital assets.

Managing Crypto Assets in a Wallet

Managing crypto assets in a wallet is an essential part of any cryptocurrency user’s financial journey. When it comes to managing digital assets, there are several types of wallets available for users to choose from, including cold storage, hot wallets, and non-custodial wallets. Cold storage refers to offline storage solutions like paper wallets or hardware devices that store private keys safely away from the internet. Hot wallets are online services that allow users to store their crypto assets on an online platform and make transactions quickly and easily. Finally, non-custodial wallets provide users with full control over their funds as they don’t rely on third parties or custodians to manage them. Each type of wallet has its pros and cons that should be weighed carefully before making any decisions regarding the management of crypto assets. Additionally, it is also important to be aware of transaction fees associated with different types of wallets when selecting a suitable solution for your needs. Finally, if you are unsure about which type of wallet is best for you, it is always recommended to consult a qualified professional before making any financial decisions related to cryptocurrencies.

No matter which wallet you choose, ensuring that your digital assets are stored securely is paramount when it comes to managing your cryptocurrency portfolio. With the right wallet selection and precautions, you can rest assured that your crypto assets are safe and sound. Get ready for the next section on storing digital assets securely in a wallet – we’ll discuss the advantages and disadvantages of different types of wallets so you can make the best decision for yourself!

Storing Digital Assets Securely in a Wallet

Storing digital assets securely in a wallet is an important part of any crypto user’s financial journey. There are various types of wallets available, such as cold storage, hot wallets, and non-custodial wallets, each with its pros and cons. Cold storage refers to storing private keys away from the internet on paper wallets or hardware devices while hot wallets are online services that allow users to store their crypto assets on an online platform and make transactions quickly and easily. Non-custodial wallets provide users with full control over their funds as they don’t rely on third parties or custodians to manage them. It is important to be aware of transaction fees associated with different types of wallets when selecting a suitable solution for your needs. Additionally, it is highly recommended to use two-factor authentication for all cryptocurrency transactions to ensure maximum security. With the right wallet selection and precautions, users can rest assured that their digital assets are safe and secure.

Making Cryptocurrency Transactions with a Wallet

Making cryptocurrency transactions with a wallet is a convenient and secure way for crypto users to store their digital assets. When selecting a wallet, it is important to research the different types of wallets available, such as cold wallets, hardware wallets, web-based wallets, and online wallets. Cold wallets are physical devices that store private keys offline and away from the internet while hardware wallets are also physical devices that contain private keys in addition to providing extra security features such as two-factor authentication. Web-based wallets are services that allow users to store their funds on an online platform while online or mobile wallets are apps that can be downloaded onto a mobile device. Each type of wallet has its pros and cons so it is important to select one that best suits your needs. Before making any financial decisions about cryptocurrency, it is highly recommended to seek advice from a qualified professional. With the right precautions in place, crypto users can feel confident making transactions with their chosen wallet.

Setting Up Two-Factor Authentication for Added Security

Two-factor authentication (2FA) is an extra layer of security that adds additional protection to your online accounts, including cryptocurrency wallets. Setting up 2FA is easy and can be done in a few simple steps. First, select the type of 2FA you want to use. Most commonly, this will be either an authenticator app or an SMS code sent to your phone number. Once you have chosen, you will need to set up the 2FA on your account by entering the necessary information and verifying it with either the authentication code from the app or the code sent by SMS. After successfully setting up 2FA, you can now rest assured knowing that any transaction made with your wallet will require both your username/password and a unique code from your preferred authentication method before it is completed.

Additional Considerations When Using Crypto Wallets

When using crypto wallets, there are a few additional considerations that users should be aware of. Firstly, it is important to consider the type of wallet that best suits your needs. Cold wallets, which store crypto assets offline in a physical device such as a hardware wallet, are ideal for those looking for maximum security. Hot wallets, on the other hand, allow users to access their digital assets quickly and easily through web-based or mobile wallets. Secondly, transaction fees should also be taken into consideration when using cryptocurrency exchanges. Lastly, users should always ensure their private keys remain secure by employing two-factor authentication when possible and storing seed phrases in cold storage if necessary. When making any financial decisions related to cryptocurrencies, it is always recommended to consult with a qualified professional to ensure you make the right choice for your situation.

Crypto wallets offer users a secure and convenient way to store and manage their digital assets. By understanding the different types of wallets, considering transaction fees, and keeping security protocols in place, users can make sure they are taking the right steps to protect their investments. Want to learn more about the costs associated with crypto wallets? Read on for our guide to understanding transaction fees!

Transaction Fees and Costs Associated with Crypto Wallets

Crypto wallets offer users a secure and convenient way to store and manage their digital assets; however, with any financial transaction, it is important to understand the associated costs. Transaction fees are typically incurred when sending or receiving cryptocurrencies, and these fees can vary depending on the type of wallet used. Hot wallets such as web-based and mobile wallets often have higher fees than cold wallets like hardware devices and paper wallets. Additionally, the amount of cryptocurrency sent or received can also impact the fee associated with a transaction. To ensure users remain informed about their transactions’ costs, crypto wallet providers usually include fee estimators within their user interface.

It is also worth noting that while cryptocurrency transactions are generally free from taxes in many countries, this could change in the future. As such, crypto users should always keep abreast of any new regulations surrounding taxation to ensure they remain compliant with local laws.

Choosing the Right Type of Wallet for Your Needs

The type of wallet you choose for your crypto assets will depend on your needs and preferences. Non-custodial wallets, such as hardware wallets or paper wallets, provide increased security since users control the private keys associated with their crypto assets. On the other hand, web-based and mobile wallets are easier to use and can be accessed from any device with an internet connection.

When choosing a wallet, it is important to consider factors such as convenience, cost, and security. For instance, if you are an active trader then an online wallet may be suitable for quickly accessing funds via cryptocurrency exchange platforms. Conversely, if you plan to store large amounts of crypto assets for a long period then cold storage solutions like hardware wallets may best suit your needs.

Ultimately, it is important to remember that no single wallet is perfect for every user; therefore users should seek independent financial advice when making decisions regarding their cryptocurrency investments. Furthermore, they should always ensure they understand the features and risks associated with any particular wallet before committing funds to it.

Conclusion

In conclusion, crypto wallets are an essential tool for securely storing and managing digital assets. Each wallet has its own unique set of features and associated risks, meaning that users should always seek independent financial advice when making decisions regarding their cryptocurrency investments. Furthermore, they should always ensure they understand the features and risks associated with any particular wallet before committing funds to it. Ultimately, choosing the right type of wallet is dependent on individual preferences and needs, as well as ensuring that two-factor authentication is enabled on all online wallets to protect against potential security threats.